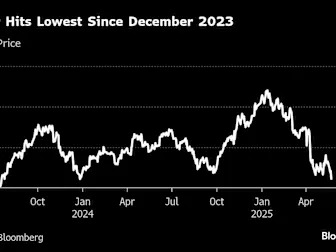

US Risks Losing ‘Reliable Investment’ Status, Allianz GI Manager Says

(Bloomberg) -- Inside one of Europe’s biggest asset managers, there’s growing concern that Republican efforts to gut legislation supporting key industries such as clean energy may result in the US losing its status as a destination for investor capital.Most Read from BloombergNY Private School Pleads for Donors to Stay Open After Declaring BankruptcyUAE’s AI University Aims to Become Stanford of the GulfNYC’s War on Trash Gets a Glam SquadChicago’s O’Hare Airport Seeks Up to $4.3 Billion of Muni