How AT&T Stock (NYSE:T) Is Back to Its Winning Ways

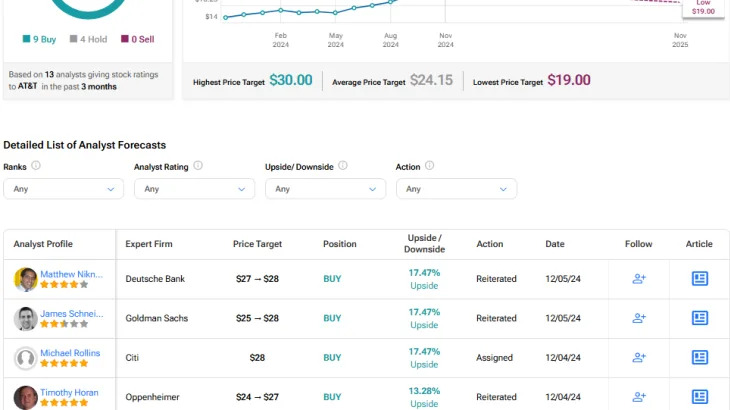

After several years in the doghouse for many investors, AT&T (T) is firing on all cylinders and back to its winning ways. I previously highlighted AT&T as a contrarian bet at the beginning of 2024, when the stock was trading at $17.31, and the stock has performed well since then, gaining over 35%. I remain bullish on the telecom giant based on its more focused and streamlined approach to the business, its commitment to returning capital to shareholders, its attractive 4.9% dividend yield, and it