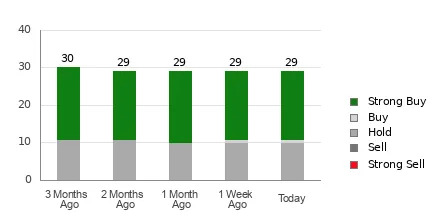

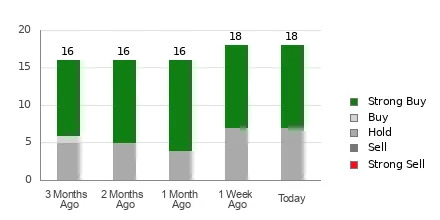

Is It Worth Investing in Gilead (GILD) Based on Wall Street's Bullish Views?

According to the average brokerage recommendation (ABR), one should invest in Gilead (GILD). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?