Hottest Debt in US Market Creeps Into Development Finance

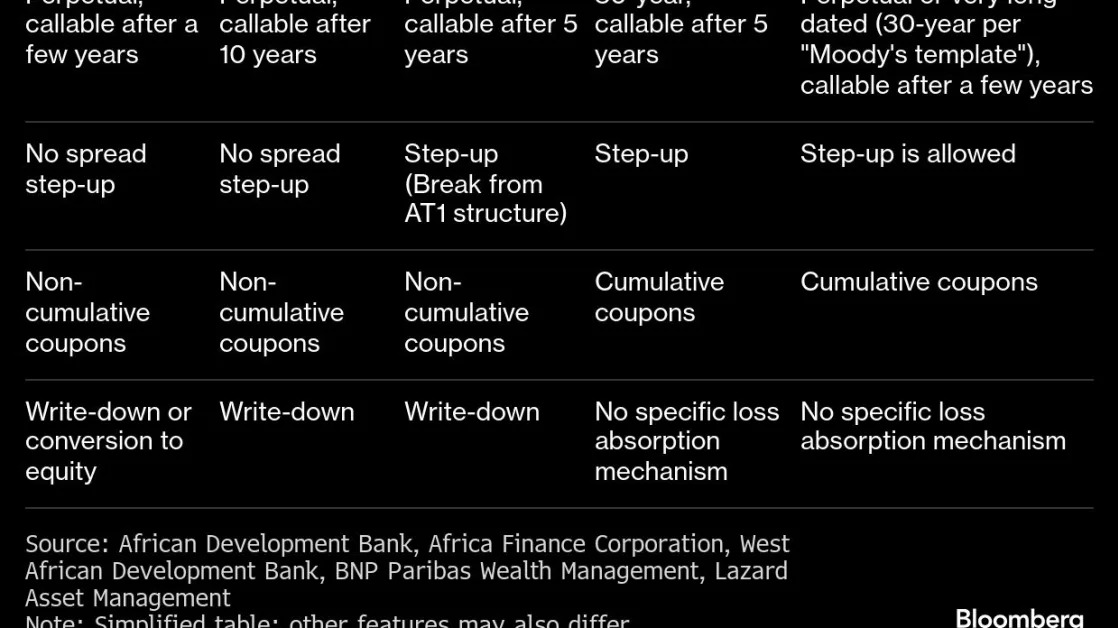

(Bloomberg) -- A type of risky debt that has taken US capital markets by storm in the past year is now emerging in bonds designed to unlock hundreds of billions in lending for the world’s poorest.Most Read from BloombergCitadel to Leave Namesake Chicago Tower as Employees RelocateTransportation Memos Favor Places With Higher Birth and Marriage RatesState Farm Seeks Emergency California Rate Hike After FiresNYC Sees Pedestrian Traffic Increase in Congestion-Pricing ZoneHow London’s Taxi Drivers N