VirTra

VTSI benefits from its military simulation training programs and wide market reach, which have played a key role in the company's overall expansion. Given its strong growth and better debt management, VTSI makes for a solid investment option in the Zacks Electronics Military industry.

Let’s focus on the reasons that make this Zacks Rank #1 (Strong Buy) stock an attractive investment pick at the moment.

Growth Forecast & Surprise History of VTSI

The Zacks Consensus Estimate for VTSI’s 2025 earnings per share (EPS) has increased 58.8% to 27 cents in the past 30 days.

The Zacks Consensus Estimate for the company’s total revenues for 2025 stands at $29.2 million, which indicates year-over-year growth of 7.9%.

VTSI surpassed expectations in the last four reported quarters and delivered an average earnings surprise of 198.93%.

VirTra’s Debt Profile

Currently, VirTra’s total debt to capital is 13.77%, better than the industry’s average of 14.13%.

VirTra’s Liquidity

VTSI’s current ratio at the end of the first quarter of 2025 was 4.54, much higher than the sector’s average of 1.14. The ratio being greater than one indicates the company’s ability to meet its future short-term liabilities without difficulties.

VirTra’s Wide Market Reach and Stable Backlog

VirTra offers innovative combat training technologies to effectively prepare the military for real-life occurrences, allowing service personnel to better protect the nation and arrive home safely. Each of the company's military simulation training programs includes real-world scenarios, cutting-edge marksmanship, precise ballistics, unique courses of fire and military weapon qualifying courses.

VirTra operates on a global scale, with its products deployed in hundreds of agencies across 40 nations. This implies the solid demand that VTSI’s products enjoy worldwide.

VTSI has a stable backlog of $21.2 million as of March 31, 2025, which reflects solid sales growth prospects for the company in the near future.

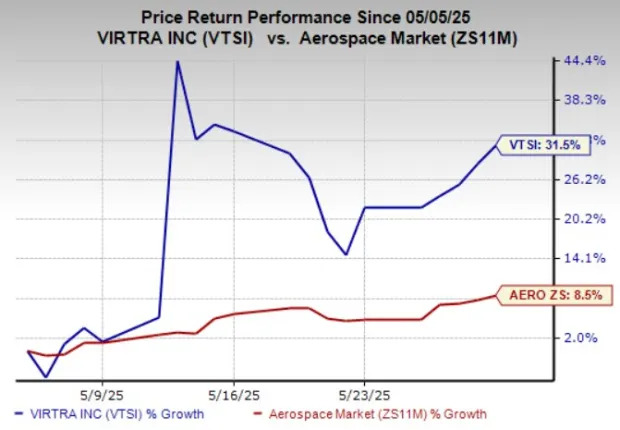

VTSI Stock Price Performance

In the past month, VTSI shares have rallied 31.5% compared with the sector’s average return of 8.5%.

Other Stocks to Consider

A few other top-ranked stocks from the same sector are

Curtiss-Wright Corp.

CW,

Woodward, Inc.

WWD and

FTAI Aviation Ltd.

FTAI, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

CW’s long-term (three to five years) earnings growth rate is 12%. The Zacks Consensus Estimate for the company’s total revenues for 2025 stands at $3.39 billion, which indicates year-over-year growth of 8.5%.

Woodward’s long-term earnings growth rate is 13%. The Zacks Consensus Estimate for WWD’s fiscal 2025 sales is pegged at $3.45 billion, which implies an improvement of 3.7%.

The Zacks Consensus Estimate for FTAI’s 2025 EPS stands at $5.14 per share, which calls for a massive year-over-year upsurge of 1,706.3%. The Zacks Consensus Estimate for FTAI’s total revenues for 2025 is pegged at $2.11 billion, which suggests growth of 21.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

FTAI Aviation Ltd. (FTAI) : Free Stock Analysis Report

VirTra, Inc. (VTSI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research